How To Start A Roth IRA

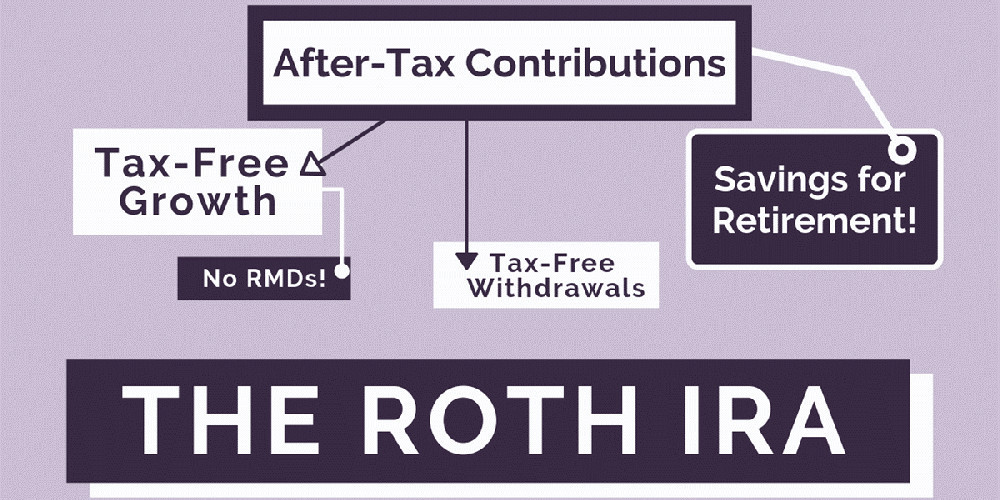

The Roth IRA is a retirement plan that offers tax-free growth and tax-free withdrawals. It’s especially popular among millennials because of its numerous benefits. This guide will teach you everything you need to know about how to start a Roth IRA, including how it works, the different types of Roth IRAs, how much money can go into one, and more!

In addition to reading this guide, you should also visit your financial adviser for expert opinions.

What is a Roth IRA?

You have a choice when it comes to retirement savings plans: You can put your money into a traditional retirement plan, such as a 401(k) or IRA, or you can opt for a Roth IRA. There’s not much difference between the two, but there are some key differences. Let’s dive in and examine them in more detail.

A Roth IRA is an entire retirement plan that is tax-free and means you have no income limit to contribute to it each year. You can put up as much as you want and your money will grow without tax consequences until you withdraw it at any time. Before we talk about how much money can be in one of these accounts, here’s a quick overview of what types of Roth IRAs exist: Traditional IRA:

This type of account was created for people with high-income levels who were approaching retirement age (typically 65 years old). They could use their savings for anything they wanted without having to worry about taxes and penalties on withdrawals (provided they were below certain limits). It’s still available today though. The biggest tax advantage comes from avoiding fees related to withdrawing funds from the account; these are minimal compared to the fees from other retirement plans like a 401K.

Understanding How the Roth IRA Works

A Roth IRA is a retirement savings plan that allows you to convert your money into a tax-free, income-producing investment with no spending limits. This type of account makes it easy for people who are not very rich but want to save for their retirement as well as people who have saved enough money but haven’t saved enough yet.

When you open a Roth IRA, you can put in as much money as you want and earn tax-free, dollar-for-dollar returns. You can withdraw from your account at any time without paying taxes on the amount withdrawn.

The benefits of opening a Roth IRA far outweigh the downsides: If you’re only saving for retirement, it’s much cheaper than traditional IRAs (which cost up to $5,500 per year), and if you’re saving for college or other non-retirement expenses, it’s easier to afford your contributions because they don’t have to be paid out of your paycheck every month.

This post contains affiliate links. Please please read my Disclaimer for more information

If you’re saving money for college or other non-retirement expenses like tuition, room and board, car payments, or rent, the biggest drawback of a Roth IRA is that there are no restrictions on how much you can take out in your first five years — this

Types of Roth IRAs

There are several different kinds of Roth IRAs. Although there are many differences between them, they share the following characteristics:

1. They provide tax-free growth.

2. They allow you to withdraw money when you want, without paying taxes until you reach a certain age (called your “distribution year”).

3. You can contribute up to $5,500 ($6,500 for those who are under age 50) at any time during your life, and during your distribution year, you can contribute an additional amount up to $6,500 ($7,500 for those under 50).

4. The amount that is withdrawn from a Roth IRA is not subject to income or gift tax in the entire distribution year if it’s not used by the end of the year.

Who Can Open a Roth IRA?

Everyone can open a Roth IRA. But only people who are under the age of 50 can make contributions to their Roth IRA. If you’re over the age of 50, you will have to pay taxes on your contributions as well as any withdrawals from your IRA. Since it’s such a popular retirement plan, there are multiple Roth IRAs that cater to different income levels and needs.

You should talk with your financial adviser to see which option is right for you and how much tax-deferred growth you’ll receive when you start contributing to your Roth IRA.

When Can You Start Opening a Roth IRA?

The Roth IRA can be opened at any time, but only after the required minimum distribution (RMD) requirement has been satisfied.

The current RMD deadline is April 1st of each year.

If you begin an IRA in the first quarter of each year, you must start by contributing right away. If you wait to open an IRA until the last quarter of each year, then your first contribution must be made on January 1st.

To help understand how much money can go into one Roth IRA, keep in mind that $5,500 is the amount required to have a one-time withdrawal from an IRA and $6,500 is needed to have more than one income-drawing withdrawal from an IRA in any given tax year.

How Much Money Can You Put Into a Roth IRA?

You can contribute up to $5,500 to a Roth IRA each year. Here are the details:

1) There is no limit on how much you can contribute to a Roth IRA.

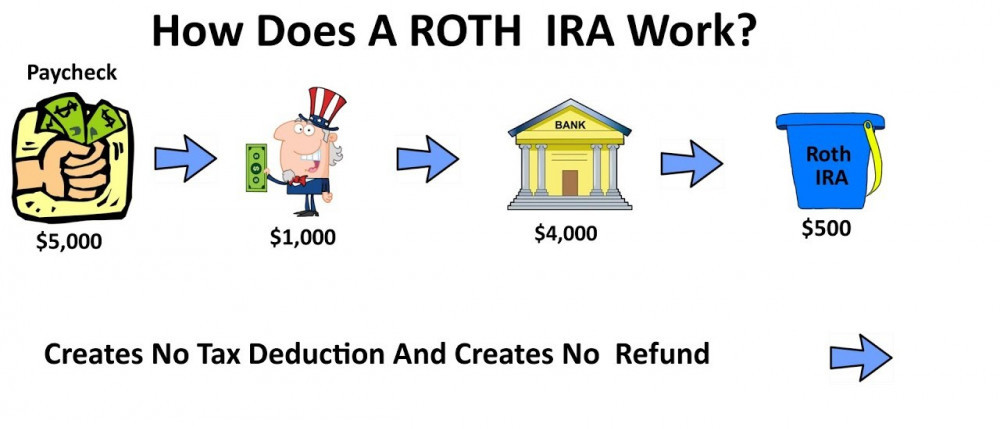

2) Contributions are not deductible so don’t worry about having to pay taxes on your contributions.

3) The maximum amount you can contribute is currently set at $5,500 ($6,000 if married filing jointly). But there is an annual catch-up contribution of $1,000 available through 2012 then reduced to $0 after that. It’s called the “catch-up” because it’s meant for those who missed out on the first contribution.

How to Open an Account and Invest in a Roth IRA

Once you’ve invested in your Roth IRA, you’ll need to open an account. This guide will show you how to do it and what requirements are necessary.

Conclusion

How does a Roth IRA work?

A Roth IRA is a tax-free retirement account, and it offers the same level of protection to your money as other types of IRAs. The features you get with a Roth IRA include:

You can withdraw up to $5,500 per year from a Roth IRA. However, if you want to withdraw more than that amount in one year, you’ll have to pay tax on each withdrawal.

Additionally, the withdrawals are not taxed until they are made; so if you make a withdrawal in 2017, it will be completely tax-free until the following year.

For example, let’s say that you’ve held onto your Roth IRA for 10 years and decided that it’s time to take advantage of its tax-free feature. You’d have time to make five withdrawals between now and April 1st next year without paying taxes on them.

“If you have any feedback about how to start a Roth IRA that you have tried out or any questions about the ones that I have recommended, please leave your comments below!”

NB: The purpose of this website is to provide a general understanding of personal finance, basic financial concepts, and information. It’s not intended to advise on tax, insurance, investment, or any product and service. Since each of us has our own unique situation, you should have all the appropriate information to understand and make the right decision to fit with your needs and your financial goals. I hope that you will succeed in building your financial future.

Daniel Tshiyole

I believe that I am not the target market here. I am only 22 years of age so I am still far away from retirement. My parents are actually approaching retirement so I will be sure to share this article with them. I am sure that they will appreciate it. Thank you so much for this lovely review.