How To Avoid Outrageous Mutual Fund Fees

Mutual funds are a popular investment option for many people. They are typically very low-risk, liquid, and cost-effective. However, there are always fees associated with mutual funds. Many investors don’t know how to avoid the outrageous fees that can be associated with investing in mutual funds. Here are some tips on how to avoid these fees so you can invest in mutual funds without breaking the bank.

What is a mutual fund?

Mutual funds are an investment vehicle that allows investors to buy and sell stocks and bonds, among other products. The mutual fund structure gives investors the ability to allocate a certain amount of money into different investments. Because there is no overall cost associated with investing in mutual funds, they can be very attractive options for individual investors.

Investors who invest in mutual funds are generally diversified. This means that you will have different types of investments ranging from stocks, bonds, and cash to foreign currencies, commodities, real estate, and more. While some of these investments may make sense for you, others may not be suitable for your financial situation.

Below are a few common types of investments offered by mutual funds:

Stocks: Stocks are one type of asset class that is used by many people to invest in their portfolios. A stock represents ownership in the company or other assets that the company owns or is involved with through its operations. Stocks can be divided into several broad categories including large-cap (those stocks larger than $100 million), mid-cap (those stocks between $100 million-200 million), and small-cap (those stocks smaller than $20 million).

Bonds: Bonds represent liabilities as opposed to assets like shares

Why are there fees associated with mutual funds?

Mutual funds are a popular investment option for many people. They can be very low-risk, liquid, and cost-effective. However, there are also fees associated with mutual funds. Many investors don’t know how to avoid these outrageous fees that can be associated with investing in mutual funds.

Some of the most common fees you’ll encounter include:

Feedback charges

Transaction-related fees and expenses

Accounts maintenance fees

Other industry-specific fees and costs

This post contains affiliate links. Please please read my Disclaimer for more information

There are also a variety of other investment options available to you if you look beyond mutual funds. For example, there’s no such thing as “passive” investments or “passive” income (at least not without sacrificing something else). Investors can invest in stocks, bonds, real estate, etc., all of which have their own set of additional costs and fees that come along with them.

How to avoid investing in mutual funds

Mutual funds are a great investment option for many investors. Investing in mutual funds can be a very low-risk way to make money by taking advantage of the market fluctuations. They are also very liquid, so you can exchange your investments immediately if you need to.

However, there are often some fees associated with investing in mutual funds. Here are some tips on how to avoid these fees so you can invest in mutual funds without breaking the bank:

Don’t invest more than 10 percent of your total portfolio into one fund unless it’s an actively managed fund that uses sophisticated strategies.

Avoid any mutual fund that charges annual management fees or expenses for any reason other than the expenses of running the fund (i.e., taxes). Such expenses include administrative costs, marketing costs, and trading expenses (both commission and spread) as well as transaction costs like commission, stop loss, and execution fees.

What do you need to know before investing in a mutual fund?

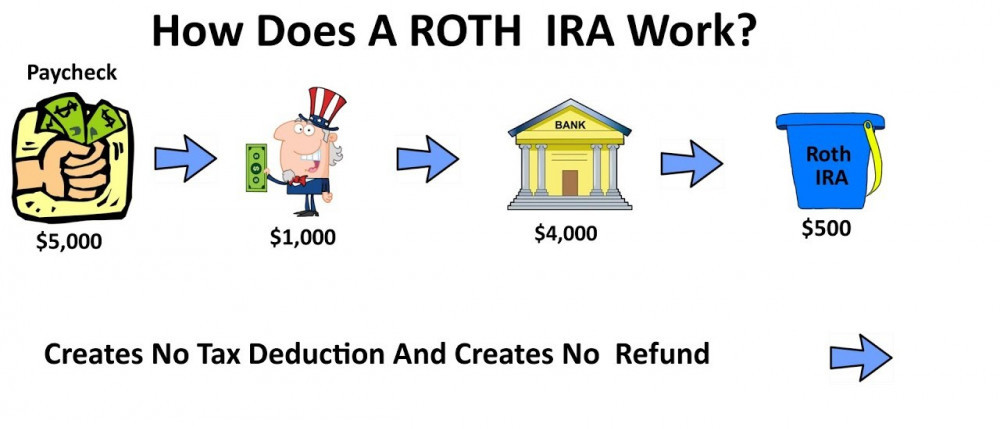

Before you invest in a mutual fund, it’s important to first understand how mutual funds work and why investors use them.

A mutual fund is an investment vehicle that pools money from many different investors and invests that money in a variety of assets. The most common asset pooled by mutual funds is stocks and bonds. A single investor can be on the phone with one fund manager, or he or she could be sending money to multiple funds to diversify their investments.

Mutual funds pay investors dividends based on the performance of their investments as well as interest payments on their deposits. So, when you invest in a mutual fund, you’re not just investing in an investment (the stock market) but also making regular payments each month on your money with the assurance that you’ll get back those dividends and interest payments (if any).

You can minimize your costs by investing through the right mutual fund company. Investing through a reputable broker or financial advisor will make it easier for you to invest through a mutual fund without having to deal with fees associated with managing your funds.

Know the risks of investing in mutual funds

.Mutual funds are a great way to invest in stocks and bonds. They allow investors to buy shares of companies that are either publicly traded or privately held. These investments can be sold at any time and they don’t require much up-front investment. However, if you have an interest in mutual funds, you need to understand the risks associated with them. Investors usually invest in mutual funds because they’re not as risky as other financial investments like stocks and bonds. That being said, investors should always research their investment carefully before investing.

Conclusion

Keep your costs low

Mutual funds are a great investment option for many people. However, they are also very high-risk investments. With the vast array of options available to invest in mutual funds, it can be difficult to keep costs as low as possible. Kicking off your investment is one of the most important steps you can take when choosing an investment option. Here are some ways you can minimize potential costs associated with investing in mutual funds:

- 1) Invest in ETFs– This is a way for investors to easily diversify their investments by investing in a basket of stocks that track an index. It’s a simple, low-cost option and usually offers superior returns over mutual funds like Vanguard or Fidelity.

- 2) Avoid high-fee brokerages like Charles Schwab and CITI– these brokers charge exorbitant fees on your money without making any improvements to their services.

- 3) Compare your broker— The better you compare brokers, the better deals you can get on your investments.

- 4) Ask for more information before you make up your mind— Many people don’t realize just how much fees their broker charges until after they’ve decided which type of fund they want to invest in.

- 5) Research the investment advisor’s background.

“If you have any feedback about how to avoid outrageous mutual fund fees that you have tried out or any questions about the ones that I have recommended, please leave your comments below!”

NB: The purpose of this website is to provide a general understanding of personal finance, basic financial concepts, and information. It’s not intended to advise on tax, insurance, investment, or any product and service. Since each of us has our own unique situation, you should have all the appropriate information to understand and make the right decision to fit with your needs and your financial goals. I hope that you will succeed in building your financial future.