What Is A Backdoor Roth IRA? How Does It Work In 2021?

Do you remember what are Roth IRAs and Roth 401(k)s? Before going into details about “what is Backdoor Roth IRA?” let’s first review them very quickly and briefly.

A Roth IRA or Roth 401(k) allows taxpayers to put aside a few thousand dollars a year into their retirement savings account. As we mentioned earlier, they are post-tax

retirement accounts, meaning that when you withdraw your fund at retirement age, it is tax-free, and all belongs to you. Why? Because you have already paid your taxes. To put it in other words, these Roth accounts are different from traditional (or regular) 401(K) or IRA retirement funds that are pre-tax. It means that such retirement plans give taxpayers immediate tax advantages (i.e., they are tax-deferred), meaning that in IRA or 401(k) plans, investors will later pay the tax on that money when they withdraw it in their retirement.

Why Roth IRA is so wanted?

Well, the answer is very simple. It has so many advantages, including:

- Roth IRA plan offers tax-free growth and tax-free withdrawals in your retirement.

- There is no age limit. You even can transfer your Roth IRA to your beneficiaries, and their withdrawals will be tax-free too.

- Roth IRAs don’t have required minimum distributions (RDMs), meaning that you can take out as much or as little as you want, and whenever you want, or leave it all for your beneficiaries. By the way, many investors intend to use their Roth as a legacy or an inheritance. Furthermore, you can keep your money in your Roth IRA account as long as you want; Thus, your fund can surely keep up growing there.

The problem is that people who earn above a specific amount are not entitled to open or fund Roth IRAs –indeed under regular rules, anyway. Now this question may arise that what are Roth IRA income limits. In 2021, the income limit for singles is $140,000, and for married couples, the limit is $208,000. Moreover, the contribution limit is $6,000 a year unless you are age 50 or older—in which case, you can deposit up to $7,000. Note that Roth IRA income limits are indexed to inflation and change annually, meaning that the higher the inflation rate, the more likely you are to see limits will go up. On the whole, your Modified Adjusted Gross Income (MAGI) must be less than the annual limit set by the IRS.

Okay, now let’s get back to our main question, What Is a Backdoor Roth IRA?

If your income is too high for a Roth IRA, you can get to a Roth through the “back door,” called Backdoor Roth IRA alternatively. Backdoor Roth IRAs are traditional IRA or 401(K) accounts that have been converted to Roth IRAs. Say differently Backdoor Roth IRA provides an option for higher-income investors who ordinarily couldn’t contribute to a Roth. Interesting ha? Okay, let’s see how we can set up a Backdoor Roth IRA?

This post contains affiliate links. Please please read my Disclaimer for more information

How Does It work?

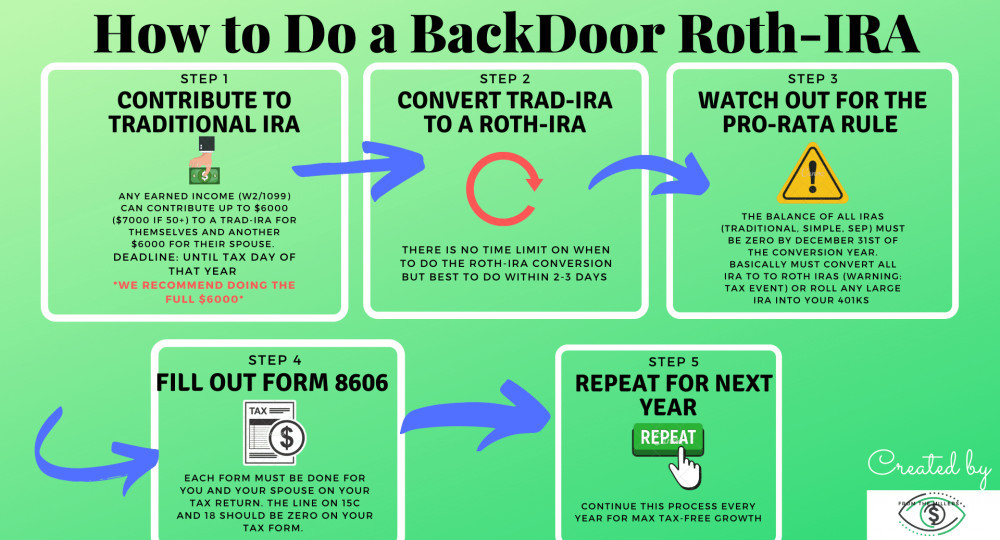

In this part, we will explain how to create a Backdoor Roth IRA. Actually, you can do that in different ways.

- You can create a traditional IRA account and then roll over the fund to a Roth IRA account. Do this account conversion as soon as possible. If you delay your conversion, everything will become too complicated. So keep life simple and stay out of trouble.

- You can create a 401(k) account and then roll it over to Roth IRA.

Is Backdoor Roth IRA Right for You? What You Need to Know?

- You have to know that this conversion to a Roth IRA account is not a tax dodge. Suppose you have $7,000 in your traditional 401(k) or IRA account and then convert your account to Roth IRA account. In this case, you still owe taxes on $7,000.

- Be aware that income limits do not apply to Roth IRA Backdoor conversions.

- Aside from getting around the limits, Backdoor Roth IRA will have significant tax savings over the decades for you; because Roth IRAs, unlike traditional IRAs, are not taxable when you withdraw the money at your retirement. In general, it is the most advantageous point of Roth accounts, whether Roth IRA or Roth 401(k), that you pay taxes upfront on your contributions and everything after that is tax-free, and all accumulated money in the fund belongs to you at retirement. It will be a very beneficial option for your retirement savings; because tax rates will go up in the future, and your taxable income will be higher after you retire than it is now. So if your employer offers you a Roth plan, never refuse it.

- The Backdoor Roth IRA is not a good idea for those who think that will need to withdraw the money they are contributing in the next five years. In this case, you will have to pay a penalty when you withdraw it.

5. Ask a financial or tax advisor for help to carry out this conversion process correctly and avoid costly tax errors. There are very subtle points in this process that if you do not know them very well, they may incur costs chargeable to you. For example, suppose you’ve rolled a 401(k) balance from an old employer into an IRA this year. In this case, if you also do a Backdoor Roth, you will wrap up owing taxes.

Conclusion

Backdoor Roth IRA allows high earners to have Roth IRA accounts indirectly. This situation illustrates a significant tax loophole. High-income taxpayers can not open Roth IRA accounts directly because of Roth IRA income limits. But, traditional IRA doesn’t have such limits and does not prevent people with higher incomes from contributing.

The Backdoor Roth IRA takes advantage of this fact and helps you maximize your retirement savings. Keep in mind that it is not a simple and straightforward process, but it is very complicated and twisty. For help in fulfilling your Backdoor Roth IRA correctly and avoiding costly mistakes, please consult a financial planner or tax advisor.

“If you have any feedback about what is a backdoor Roth IRA that you have tried out or any questions about the ones that I have recommended, please leave your comments below!”

NB: The purpose of this website is to provide a general understanding of personal finance, basic financial concepts, and information. It’s not intended to advise on tax, insurance, investment, or any product and service. Since each of us has our own unique situation, you should have all the appropriate information to understand and make the right decision to fit with your needs and your financial goals. I hope that you will succeed in building your financial future.

Leahrae

I don’t have an IRA period, but my son does. So this is great information for him as he is still young and he needs to plan for his financial future. You never know what is going to happen financially or with your job. The significant tax savings all by itself seems like have a back door Roth IRA so worth it. Thanks for the greet information, I will forward this post to my son.