Why Is Financial Literacy So Important?

What Is Financial Literacy And Why Is It Important?

In everyday life, we all face different financial issues and, we have to make decisions against each of these issues that affect our quality of life.

Issues such as where do I keep my money so that its value is maintained over time?

How do I allocate my limited income to unlimited demands to get the most out of it?

How do I plan to achieve my goals?

How can I manage my income and expenses so that I can save?

How do I manage my expenses?

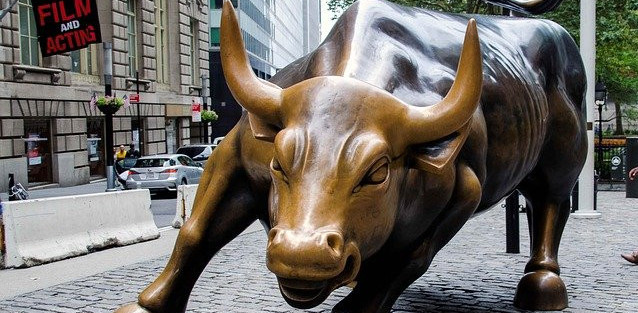

Should I save my money at the bank or invest in the stock market, gold, and housing?

To answer all these questions and many other questions, one needs financial literacy knowledge. In the following, I want to introduce you to the concept of financial literacy and explain to you why knowing financial literacy is necessary for everyone.

What Is Financial Literacy?

Financial literacy is the intersection of financial management, credit, debt, and the knowledge needed to make responsible financial decisions, that is, decisions that affect our daily lives financially. Financial literacy includes understanding how a checking account works, using a credit card, and how to avoid debt.

This post contains affiliate links. Please please read my Disclaimer for more information.

In general, financial literacy affects the issues that a typical family pays attention to when trying to balance the budget, buying a home, financing children’s education, and earning an income in retirement.

The level of financial literacy varies by level of education and income level, but evidence shows that highly educated, high-income consumers can also have as many financial problems as people with lower education and lower incomes. The only difference is that the latter group will probably be more resistant to learning.

Financially Literate Person:

Having literacy helps you to strengthen your abilities and skills in the face of many situations. The financially literate person gains new insights into their behavior and performance. In the following, we examine the characteristics of people with financial literacy from 6 main areas of financial literacy.

- Earn money:

- Recognize your abilities and guide them to earn money.

- Can offer his / her abilities to others.

- Can review and compare different job options and choose the best option.

- Recognizes the true value of the services it provides to others and the products it produces.

- Familiar with the principles of taxation and the need to pay it.

- Knows the difference between net and gross income.

- Spend:

- Knows his emotions and has the ability to manage purchases.

- Distinguish between wants and needs: Recognizes wants and needs and can prioritize between them.

- In bargaining situations, he has the ability to bargain and can buy what he needs at a lower cost.

- He can know his resources, including money and non-cash assets, and understand its limitations so that he can make the best decision to spend these resources.

- Money management:

- It can balance its income and expenses and budget for itself.

- Knows goal setting methods and can plan to achieve his / her goals.

- Knows decision-making methods and can use them to make the most appropriate choices.

- Savings and investment:

- He knows what it takes to save and why he should save.

- He can wait and postpone his wishes.

- He is familiar with the function of the bank and can have a proper evaluation and comparison of different banks.

- Knows the different options for keeping money and can choose the best option.

- Familiar with various banking services such as checks and their rules.

- He knows that the value of money decreases due to inflation over time and seeks appropriate options to maintain this value.

- It can identify different risks and select the less risky option.

- Risk management and insurance:

- He knows when it comes to financial planning, in addition to paying attention to raising money, he must also think of ways to protect it.

- It can identify various risks and look for ways to reduce them.

- Knows the types of insurance and has the ability to identify the right insurance for you.

- Credit and debt management:

- Has the ability to recognize the benefits and disadvantages of using debt.

- Recognizes the importance of building trust and strives for it.

- Has a good understanding of the effects of not paying your debts on time.

- He knows that using debt comes with a cost, and he has the ability to calculate the cost of that debt.

Why Is Financial Literacy Important?

The importance of financial literacy is because it introduces us to the basic concepts of finance so that we can make informed decisions in real life. With this knowledge, we can better manage our money, make more informed decisions, and maintain healthy spending and budgeting habit that leads to financial well-being over time.

This knowledge becomes more important to us when faced with various financial challenges. When we say that a person is financially literate, we mean that an understanding of financial concepts is essential.

Who Needs More Financial Literacy?

Some people think that financial literacy only belongs to a certain class, for example, it is thought that people who are poor and from the lower classes of society need this knowledge more.

If each of us has unlimited demands with any amount of income and coordinating these demands with the resources at our disposal is one of our daily concerns and we must choose one of the various options.

For example, to which of my wishes should I allocate the number of resources (money, time, etc.) I have? How do I achieve my financial goals? Or how can I manage the wealth that my parents inherited for me so that it does not reach zero?

How do I teach my child to realize that he is spending his money on valuables? And thousands of other questions that show that financial literacy is needed for all members of society and is related to the issues of our daily lives, so it is not related to a specific group and we all need to be familiar with financial literacy.

Conclusion

Financial literacy shows itself more at the time of retirement. People with high financial literacy save twice more than people with insufficient financial literacy. In other words, people with less financial literacy pay more for their wrong decisions. The group also did not invest, struggling with debt and poor understanding of loan terms.

In this article, we examined the characteristics of wealthy literate people and then explained the importance of financial literacy and for whom this issue is more important. We hope you find this article useful.

“If you have any feedback about why is financial literacy so important that you have tried out or any questions about the ones that I have recommended, please leave your comments below!”

NB: The purpose of this website is to provide a general understanding of personal finance, basic financial concepts, and information. It’s not intended to advise on tax, insurance, investment, or any product and service. Since each of us has our own unique situation, you should have all the appropriate information to understand and make the right decision to fit with your needs and your financial goals. I hope that you will succeed in building your financial future.