Why Is It Important To Live Within Your Means?

Having a deep understanding and knowledge about finance comes with it’s own challenges. To overcome these challenges, we need to increase our comprehensive studies. Nowadays we can do that with the advance of technology. It helps us to understand the terms better. But still it does not mean that we need to forget old techniques and methods. In our article you’ll find the synthesis of these two methods regarding finance. The benefits you’ll get will increase the excitement you’ll have reading these sentences.

To understand the term better, ‘’living within your means’’ we first need to focus on our sentence and analyze it deeper. ‘’Living within your means’’ simply means that you need to consume less than you produce. In other words your income should exceed your outcomes. When we deconstruct the sentence like this theoretically, obviously it sounds easier as if we can perform and realize everything that is written here.

This post contains affiliate links. Please please read my Disclaimer for more information.

On the other hand, when it comes to applying these theories into practice most of us fail. Because it’s the mindset that we should have for the long term. Comparing all these rich and smart people that succeeded, most of the people give up in the beginning or without even trying at all. It’s because they don’t share the same mindset with the rich people. It’s not a fault or mistake by the way. But that’s why we have our educational content for you. We want you to get more education reading our website.

To make our point even more striking, we have a quote for you from Warren Buffet, the greatest investor of all times. He says in his famous speech that ‘’If you buy the things you don’t need, soon you’ll have to sell things you need’’ Our point could not be clearer with this quote from Warren Buffet. What he is trying to say in this quote is that, ıf you consume more than you produce wealth or value, soon you’ll also lose what you have consumed. It shows the importance of creating value or wealth before consuming. That’s why we’re trying to share with you the mindset of living within your means.

So far you’ve seen the meaning of the term ‘’living within your means’’ , the importance of having this mindset throughout your finance career and your life , you’ve also seen a crucial quote from the most famous financier of all times. Now if you absorbed everything that was written and want to learn more, we’ll teach you how to do it step by step. But please keep in mind that you’re in a self learning process. We are just helping you to learn on your own with our studies. So if you’re sharing the same mindset and ready for the next part. Let’s move on with our next chapter.

In order to thrive in living within your means you first need to concentrate on your incomes. That’s the first part of this journey. In other words you need to calculate the earnings you make in a day, a week, a month etc. If you have a detailed chart of your earnings. It will make it easier for you be more scheduled and spend less in the process.

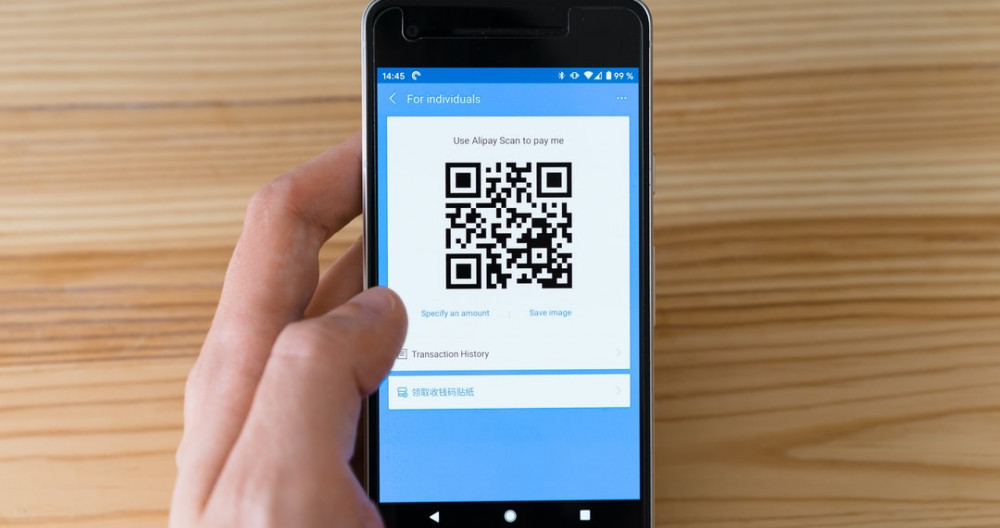

After the calculations are done, we’ll concentrate on decreasing our spending, as mentioned before, our incomes should exceed our outcomes. That’s why our second object will be cutting our spending and increasing our income. After you consume less and cut your spending, we’ll focus on increasing our income. There are various methods for that. We canmainly do that by creating different income models, such as creating websites, streaming online, trading, commerce, marketing.

These aspects of online business models will help you build passive income for your future and it will also help you to create additional value and income. But don’t forget that the key point here is to first focus on decreasing your spending first and increasing your income. Online models are just one of the fastest growing models for creating an income. There are also different models that you can apply in your area or neighborhood. The ideas differ and they’re all acceptable as long as you put some additional value in it.

After doing our calculations and spending our cutting, the last objective we’ll focus will be to stop depending on debts as a whole. Debts can include credits or the regular funding coming with an interest. It’s crucial to abstain from interest rates since together with the inflation it’s one of the aspects of causing you lose money. If you remember our previous sentences, our main objective was to stay away from extra spending, Besides, these spending with an interest rate will even cost you more in total when you consume more.

Conclusion

To sum up, through your journey to your financial independence, it may feel tough to change your habits in the beginning, but together with the advices you get from our website and related articles, you’ll get a deeper understanding and shape your mindset for the future goals. Taking notes, reading, doing your research and studying more with a practice make your goals even clearer. It’s all up to the effort you put in to realize these goals.

In this article we shared 3 main objectives with you to help you achieve your financial independence. We first introduced the idea of defining your incomes clearly, secondly we made it clear why it’s important to cut your spending and lastly we highlighted why you should abstain from additional costs such as interest rates and debt payments. We hope that you found it helpful and aspiring. Taking these into accounts, we wish you a better future building your wealth. Our next chapter will be about How much do you need to retire ? Please take a look at our next article as well. We are doing our best to help you achieve your goals.

Thank you for reading and stay tuned…

“If you have any feedback about why is it important to live within your means that you have tried out or any questions about the ones that I have recommended, please leave your comments below!”

NB: The purpose of this website is to provide a general understanding of personal finance, basic financial concepts, and information. It’s not intended to advise on tax, insurance, investment, or any product and service. Since each of us has our own unique situation, you should have all the appropriate information to understand and make the right decision to fit with your needs and your financial goals. I hope that you will succeed in building your financial future.